Feels like there will never be enough

Ever feel like no matter how much you have in the bank, it just won’t be enough?

You aren’t alone. Does this sound familiar?:

You hate dipping into your savings, even if it really is an emergency

Despite running daily, you make due with your old, worn-through shoes.

You buy booze that is 1/4 as good and 1/2 the price of the type you actually like.

You have a good living situation, a good-paying and secure job, some manageable debt, and tens of thousands in savings. And you worry about money all the time.

Why do we worry?

Why isn’t there ever enough?

Because we view our money with 90% emotion and 10% logic when it should be the other way around.

The psychological reasons for this issue are different for everyone. That’s the subject for a another post. This is about how to fix the situation.

How can we go from worry and losing sleep to feeling that we have prepared as best we could for whatever life throws at us?

Set goals

Not having a goal is like entering a race without knowing how many laps you have to run and all your competitors are invisible. Sure, you can run and run and run and run, but you’ll never know what place you’re in or how much longer you have to go or if you’ve finished and running for no reason. Meanwhile, people are lounging off on the sidelines laughing, drinking mimosas, and snacking on mini-pizzas while you’re still going round and round.

For too many people, their financial plan is, “Don’t spend money. Save as much as you can.” I’m not saying that’s not a decent plan, it’s better than the reverse, but it’s mentally burdensome and keeps people from enjoying their lives. They weigh every. single. purchase. they. make. And then they feel guilty about buying an item or buy a cheaper version that quickly wears out or doesn’t actually do the thing they need. On top of the guilt and waste of money on something they need to replace, they spend valuable time looking for a better deal or figuring out how they can go without. Never forget, money comes and goes, time only goes.

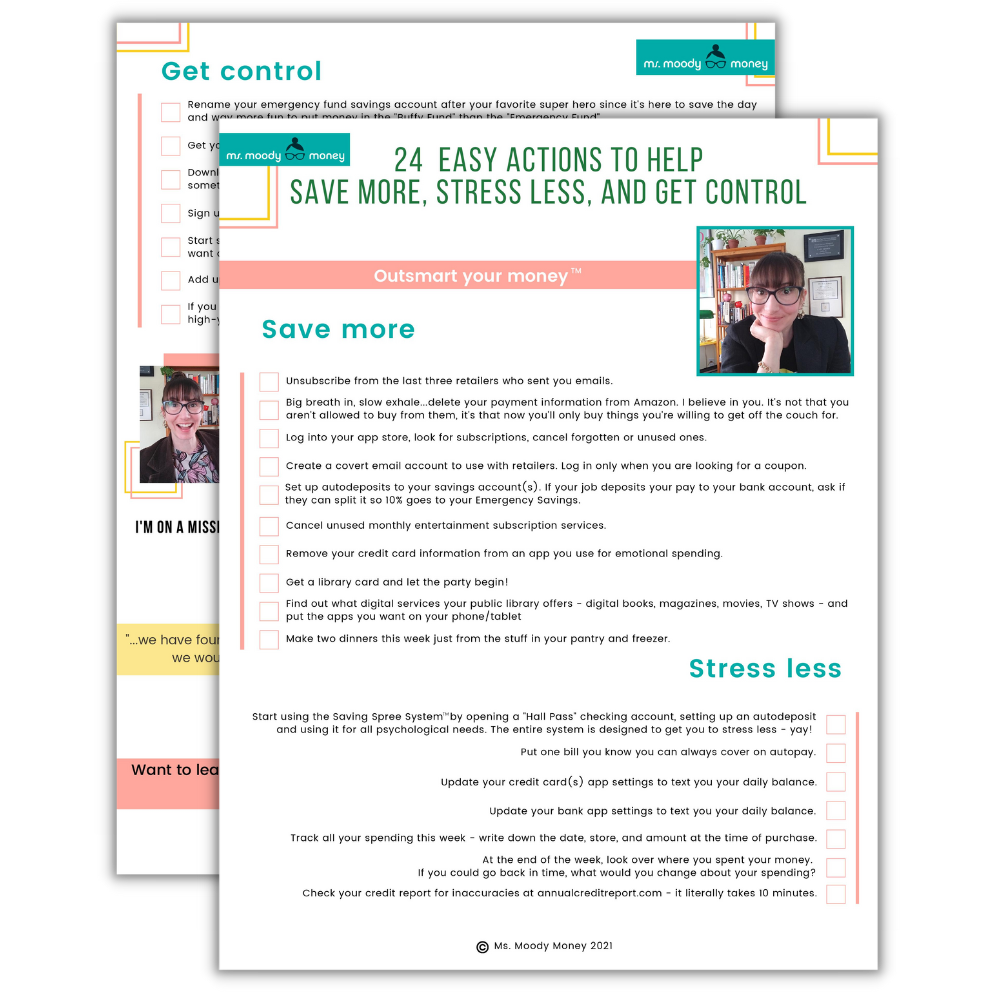

This rule is for every savings goal you have. I’ll use most people’s most pressing account as an example here: the Emergency Savings (aka, the Buffy Fund, but name yours whoever your favorite superhero is).

How to set achievable goals so you can relax knowing there’s enough:

Do some research, find out what the rules of thumb are.

Notice I said rules of thumb. There are no hard and fast “rules” when it comes to how to manage your money. I know, you’ve seen people be very ardent about following strict rules but, because of variations in needs, income, expenses, debts, and life goals, personal finance is always just that, personal. Figure out what the experts recommend and adjust it to your life.

For emergency funds, a very quick and dirty method I recommend for the absolute most you want to set aside is 25% - 50% of your annual take home. Any more than that and you are LOSING MONEY unnecessarily since money in a savings account doesn’t even keep up with inflation (the rising cost of goods).

The not quick-and-dirty but far more accurate number is to have six months to a year of survival expenses, all the things you need to keep carbon-based you and your kids/pets alive, in your Buffy Fund. This requires you to calculate your survival expenses first. Which is why I gave you the other method so you have an easy starting point.

Those are MY rules of thumb. Some people say only keep $1,000 in the Emergency Fund. Some say 1 month’s salary. Some say 3 months of expenses. You know who’s right? All of us. It’s like claiming there’s only one good brownie recipe. No such thing. There are lots of great brownie recipes, whichever you prefer is down to your own tastes. If your Buffy Fund is between $1,000 and half a year’s income, consider yourself in a decent spot but you will need to adjust for your needs and situation. On to step 2!

2. Determine your goal number

Now that you have an idea of what the experts recommend, translate that into your own life. Let’s say you take home $5,000 a month, $60,000 a year, and you just read the above. You just read that the quick and dirty number you need is between $1,000 and $30,000 in your Buffy Fund. To narrow that down, so consider these factors:

How stable is your job?

What things in your life can break?

How much do you (and any creatures dependent on you) need to survive per month?

I’ll use real survival expenses for the example, but if you don’t know them, just use the first two questions to determine your goal amount.

If you have a very stable job, rent an apartment and take public transport, and can easily live on $1,500 a month, then you should aim towards the lower end of what I recommend, six months of survival expenses, or, $9,000. The exact number you decide on is up to your comfort level.

If, however, you are a freelancer, own your home, own a two year-old Prius, and have $3,000 in monthly survival costs, you’ll need as much as you can in your Buffy Fund. Your income is too variable and your expenses can easily go into the thousands with one busted water heater or a transmission issue. Ideally, you would aim for a year’s worth of survival expenses, or $36,000.

How do you get to your goal?

3. Break it up into realistic, bite-sized pieces with due dates

Let’s say you want to raise your Buffy Fund to $30,000 from its current $740. That seems like an impossible task. Start by aiming for $1,000. That’s $260. Easy. You put a recurring event in your calendar to transfer $60 a week for the next five weeks which puts you over the top. Celebrate!

When you hit that, go for $2,000. $60 a week was pretty easy. You decide to try $100 a week so you’ll hit $2,000 in ten weeks. Instead of manually transferring the money, you set up a $100 automatic deposit and put a note in your calendar ten weeks from now to celebrate when you hit that goal.

Take a breath and evaluate. If $100 a week didn’t put too much of a damper on your life, then challenge yourself to get to $3,000 in two months. Adjust your deposit to $125 and put a note in your calendar so you can celebrate when it happens. Instead of keeping your eyes on the $30,000, achieving the smaller goals regularly helps you understand that you are making great progress, even if there is still a lot to go.

Celebrating milestones is important! Whenever your Buffy Fund ticks up another thousand, get a fancy Belgian beer or make a special trip to a park you love. Something simple you’ll enjoy, doesn’t cost more than a few dollars, and you don’t do often.

Before you realize it, you’ll hit your target. You may need to dip into it a few times but that’s what the money is there for. It’s a cushion. Imagine yourself falling from 10 feet high, by building your Buffy Fund, you are choosing now whether to hit concrete (borrow money from friends/family or pay with a credit card that you can’t pay off) or land in an inflated bouncy castle (use the Buffy Fund). You choose bouncy castle, every time. Even though you didn’t want to fall, you didn’t enjoy falling, you walked away without a scratch. That’s what the Buffy Fund does. Saves the day, every time.

Even if you’re just setting aside $10 a week, you’ll have $520 in a year. That’s huge! That small amount may not seem like much until you have to replace your windshield after a rock hits it and are able to hand over a check instead of a credit card.

Having a goal lets you know how close you are to finishing. Making a plan lets you know you will finish. Otherwise, you’ll never feel comfortable, you’ll never have a sense of achievement, and you’ll still worry about your money. And that life is no fun.

Cheers,

Ms. Moody